REGRESSION ANALYSIS: EXPLAINING OVERHEAD COST

This is my

Business Analytics topic on Scatterplots Graphing Relationships.

The Finance

manager of a factory wants to get a better understanding of overhead costs. These

overhead costs include supervision, indirect labor, supplies, payroll taxes,

overtime, depreciation, and a number of miscellaneous items such as insurance,

utilities, and janitorial and maintenance expenses. Some of these overhead costs are fixed

whereas others are variable and do vary directly with the volume of work.

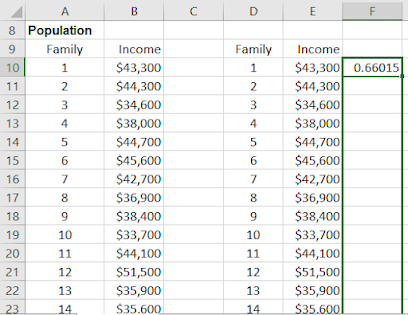

The Finance

Manager has tracked total overhead costs for the past 36 months, To help

explain these, he has also collected data on two variables that are related to

the amount of work done at the factory. These variables are:

·

Machine

Hours: number of machine hours used during the month

·

Production

Runs: the number of separate production runs during the month.

Objective:

To use scatter plots of Tableau to examine the relationships among overhead,

machine hours, and production runs.

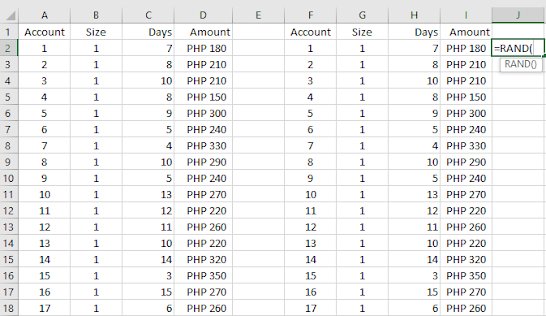

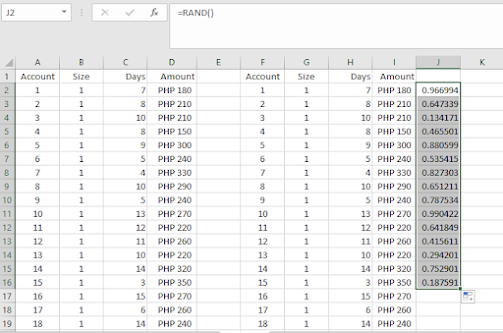

The data is

available at https://github.com/alcadelina/business-analytics-excel-data

The output:

Step 2.

Step 3.

Step 4.