QUALITY WORK IN COMPUTING

DEPRECIATION

The family of depreciation functions includes both the

straight-line approach and the accelerated methods, declining balance and sum

of years digits.

Excel has the following depreciation functions:

• SLN. Short for "straight line." You know what

this one does: it divides the depreciable value of an asset equally across its

useful life.

• SYD. Short for "sum of years' digits." The most

basic of the accelerated depreciation functions.

• DB. Short for "declining balance." The

accounting literature often refers to this as "double declining

balance," and the DB function can work in this way.

• DDB. Short for "double declining balance."

Again, it is possible to use this function in the usual way, to double the

straight-line rate, but you can optionally supply other rates.

The depreciation functions take just a few arguments, which

must be listed in a specific order, and not all the arguments are required. The

arguments common to all the depreciation functions include the following:

• Cost. The original book value of the asset you're

depreciating. Required by all depreciation functions.

·

Salvage. Excel uses the term "salvage"

in place of "residual," and to avoid confusion this chapter does the

same. The value of the asset at the end of the final depreciation period.

Required by all depreciation functions.

• Life. The number of accounting periods, normally years, over which the asset is to be depreciated. Required by all depreciation functions.

• Period. The period for which the depreciation is to be

calculated. Required by all the depreciation functions, except SLN (which by definition

returns a constant figure regardless of period).

In this context, "required argument" does not mean

that you have to supply a value. It does mean that you have to account for it.

For example, =SLN(1000,0,5)

specifies a Cost of 1000, a Salvage of 0 and a Life of 5. An

equivalent usage is

=SLN(1000,,5),

which does not supply a Salvage value but accounts for it by

means of two consecutive commas. The Salvage argument would normally go there,

but because it's missing Excel assumes that Salvage is 0.

The SLN function returns the amount of depreciation to take

in each period. It con[1]forms to the usual

tax regulations in requiring that you supply a salvage value that is subtracted

from the original book value before calculating the depreciation.

The SLN function syntax is:

=SLN(Cost, Salvage, Life)

Figure 1 below shows how you might lay out a worksheet to

give names to cells and make it easier to enter and edit the values of the

three arguments, whether you decide to use the function wizard or to enter the

function and its arguments directly on the worksheet.

Accelerated

Depreciation

Besides straight-line depreciation, Excel provides for four

methods of accelerated depreciation. Accelerated depreciation front-loads the

depreciation in the earlier periods of an asset's useful life. The rationale is

part cupidity and part logic.

As to greed: we usually like to depreciate greater amounts

earlier.

As to logic: it's just an extension of the matching

principle. To the degree possible, costs should appear in the same accounting

period as the benefits they bring to a company. Other things being equal, the

newer an asset, the greater benefit it offers. Therefore, the greater portion

of the asset's cost should also be recognized earlier.

The Excel functions that accelerate depreciation beyond a

straight line are SYD,DB and DDB.

2. SUM-OF-THE-YEARS-DIGITS

The most straightforward of the accelerated depreciation

methods is SYD, sum of years' digits. Figure 2 shows how you might set up the

worksheet to take advantage of the SYD function.

Like the straight-line approach, the sum of years' digits

method requires that you apply the depreciation factor to the asset's

depreciable value – the difference between the original cost and the salvage

value. The syntax for the SYD function is:

=SYD (Cost, Salvage, Life, Per)

3. DECLINING BALANCE

In the traditional method of calculating declining balance

depreciation, the straight[1]line rate is doubled.

If an asset is judged to have a useful life of four periods, the straight-line

method would depreciate it at 25% per period; 25% would be applied to the

difference between the cost and the salvage in each period.

The syntax of the DB function is:

=DB(Cost, Salvage, Life, Period, Month)

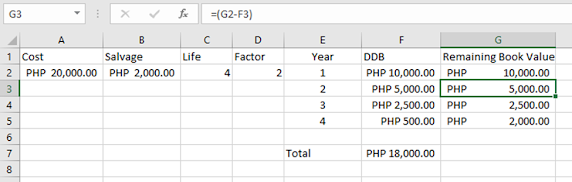

4. DOUBLE-DECLINING BALANCE

I have better news regarding Excel's DDB function than I did

regarding its DB function – and it's not limited to the fact that the Period

argument in DDB is Period instead of Per.

The DDB function allows you to specify a particular rate of

depreciation, with reference to the SLN rate. That is, you can specify a Factor

argument that is multi[1]plied by the SLN

rate, which is determined by the asset's useful life. (DDB is short for double

declining balance.)

In contrast to the DB function, the rate of depreciation

used by DDB is not determined by the salvage value. It is determined by

dividing the Factor argument by the asset's useful life.

Furthermore, the DDB function does not base periodic

depreciation on the asset's original cost less a salvage value – in fact, the

only reason that the DDB function takes a Salvage argument is to determine when

to stop calculating depreciation.

Here's DDB's full syntax:

=DDB(Cost,Salvage,Life,Period,Factor)

Now you learn how to compute Depreciation, remember it is very important in your business because depreciation is an expense and accounting entails how much value your business assets lose every year. Remember depreciation as a loss and must be subtracted from your revenue.

Computing depreciation helps the business to cover the total cost of an asset over its lifespan instead of immediately recovering the purchase cost which would see one large cost and lower profits.

No comments:

Post a Comment