Earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation, and amortization (EBITDA) are common calculations for evaluating the results of a business.

Earnings before interest and taxes (EBIT) is a company's net income before income tax expense and interest expense have been deducted. EBIT is used to analyze the performance of a company's core operations without tax expenses and the costs of the capital structure influencing profit.

While EBITDA or earnings before interest, taxes, depreciation, and amortization is another widely used indicator to measure a company's financial performance and project earnings potential. EBITDA excludes taxes and interest expense on debt as well as depreciation and amortization expenses. As a result, EBITDA reflects the profitability of a company's operational performance before deductions for capital assets, interest, and taxes.

Both are computed by adding back certain expenses to earnings, also known as net profit.

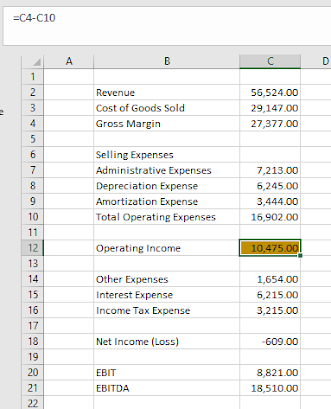

Figure below shows an income statement and the results of the EBIT and EBITDA calculations below it.

Earnings before interest and taxes EBIT

=C18+VLOOKUP("Interest Expense",$B$2:$C$18,2,FALSE)+VLOOKUP("Income

Tax Expense",$B$2:$C$18,2,FALSE)

Earnings before interest, taxes, depreciation, and amortization EBITDA

=C20+VLOOKUP("Depreciation Expense",$B$2:$C$18,2,FALSE)+VLOOKUP

("Amortization Expense",$B$2:$C$18,2,FALSE)

Step 1. Compute the Gross Margin

Step 2. Compute the Total Operating Expenses

Step 3. Compute the Operating Income.

Step 4. Compute the Income (Loss)

Step 5. Compute Earnings before interest and taxes EBIT

=C18+VLOOKUP("Interest Expense",$B$2:$C$18,2,FALSE)+VLOOKUP("Income

Tax Expense",$B$2:$C$18,2,FALSE)

The EBIT formula starts with net loss in C18 and uses two VLOOKUP functions to find the interest expense and income tax expense from the income statement.

Step 6. Compute the Earnings before interest, taxes, depreciation, and amortization EBITDA

=C20+VLOOKUP("Depreciation Expense",$B$2:$C$18,2,FALSE)+VLOOKUP

("Amortization Expense",$B$2:$C$18,2,FALSE)

For EBITDA, the formula starts with the result of the EBIT calculation and uses the same VLOOKUP technique to add back the depreciation expense and amortization expense.

There is a benefit to using VLOOKUP rather than simply using the cell references to those expenses.

If the lines on the income statement are moved around, the EBIT and EBITDA formulas won’t need to be changed.

You now know how to compute the EBIT and EBITDA using Excel.

Happy Financial Modelling everybody!